Case Studies

Ready to increase cash flow and save on taxes? Call now for a free analysis on your property (801) 764-9100

APARTMENT COMPLEX

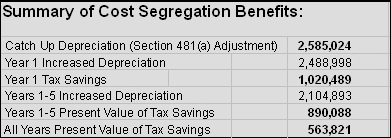

An owner purchased an apartment complex in the year 2000 for $8,000,000. For their 2006 taxes they did a cost segregation study. The following table shows the owner's benefits from doing a study.

By doing a cost segregation study the owner saved $1,020,489 in taxes in 2006!

INVESTMENT GROUP

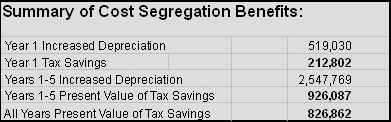

An Investment group constructed an office complex in 2007 for $19,000,000 and had a cost segregation study performed as soon as the building was completed. The following table shows their benefits.

SOLD PROPERTY

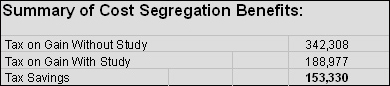

An building owner bought a retail complex in 2000 for $4,000,000 and sold the property in 2007 for $5,000,000 they then had a cost segregation study performed for their 2007 tax year. The following table shows their benefits.

We have many more cases that we'd love to discuss with you! Let us see what a cost segregation study can do for you! (801) 764-9100

|